The Law Of Category Entry Points

Own the moment of need.

You’re still obsessed with brand love while your customers only think about you when their stomach growls or their boss is screaming about a deadline. Wake-up call: nobody wakes up dreaming of your SaaS platform or your artisanal soda. They wake up with problems, contexts, and triggers. If your brand isn't the first thing that pops into their lizard brain when they're rushed for time or feeling fancy, you don't exist. You’re not a brand; you’re a ghost. Let's stop the spiritualism and start building some actual mental real estate before your budget evaporates into the brand purpose abyss.

THE LAW OF CATEGORY ENTRY POINTS

“Your brand grows when people automatically think of you in specific buying situations. The more situations linked to your brand, the more chances you have to be chosen.”

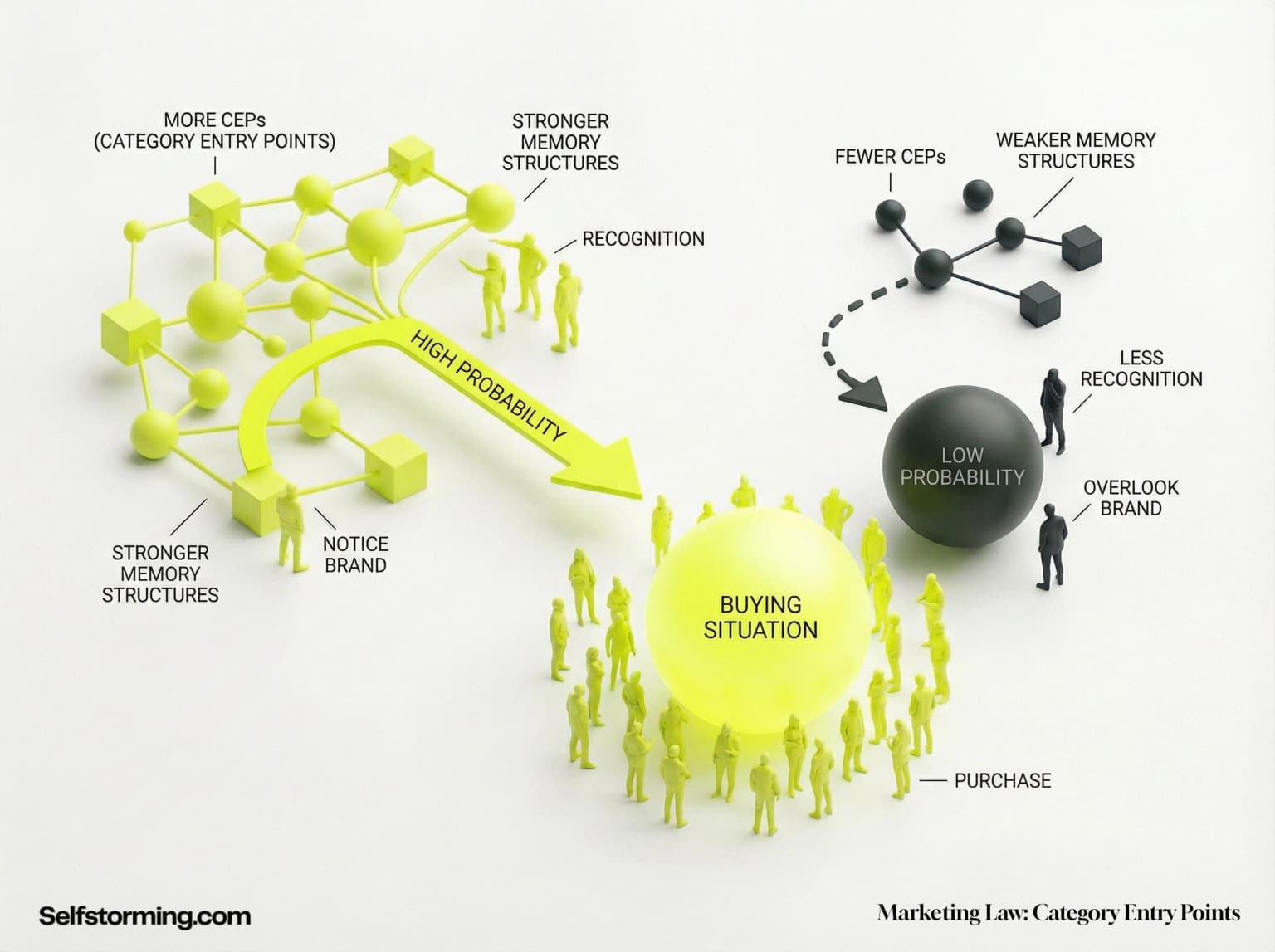

Category Entry Points (CEPs) are the mental cues, triggers, and situations that consumers use to access their memory when a purchase need arises. According to the Ehrenberg-Bass Institute, brands do not grow by deepening the love of existing users, but by increasing the number of mental links between the brand and various buying situations. This is the foundation of Mental Availability. To grow, a brand must be thought of by more people, in more situations. If your brand is only linked to one specific use case (e.g., a morning coffee), your growth is capped. By identifying and capturing more entry points (e.g., coffee for a mid-afternoon slump or coffee for a social meeting), a brand increases its probability of being chosen across the entire category repertoire.

Key Takeaways

- Growth requires increasing the number of situational triggers linked to your brand.

- Buyers have repertoires; they choose brands based on the specific context of the moment.

- Mental availability is a game of probability, not a game of brand loyalty.

- Identify the 7 Ws to map the mental landscape of your category.

- Advertising must explicitly show the buying situation to build a memory link.

Consequences Of Applying The Law

| Aspect | When Applied | When Not Applied |

|---|---|---|

| Brand Positioning | The brand is positioned as a solution for a wide array of diverse situational triggers (e.g., for a quick energy boost, to share with friends, as a reward after work). This increases the probability of the brand being thought of across multiple buying occasions. | The brand focuses on a single, narrow unique selling proposition or an abstract emotional archetype. This limits the brand's mental footprint to a small set of circumstances, making it invisible when consumers are in different buying contexts. |

| Creative Strategy & Messaging | Advertising explicitly depicts the who, when, where, and with whom of the category. Visual and verbal cues link the brand to specific physical and social environments, reinforcing the associative memory network in the buyer's mind. | Ads focus on abstract brand values, high-concept metaphors, or brand personality without showing the product in use. Consumers may like the ad but fail to retrieve the brand from memory when a specific situational need actually arises. |

| Media Planning | Media is scheduled to reach consumers at or near the moment of specific CEPs (e.g., breakfast cereal ads on morning radio). This strengthens the recency of the association between the situational trigger and the brand. | Media is bought purely based on broad demographic reach or lowest CPM. While the brand reaches many people, the message is disconnected from the temporal or situational contexts where the purchase decision actually happens. |

| Measurement & KPIs | Success is measured by Mental Market Share - the percentage of category entry points a brand is linked to within the target population. Growth is tracked by the brand's ability to capture new situational white space. | Success is measured through Brand Love, Advocacy, or Loyalty scores. These metrics fail to account for the repertoire nature of buying and do not predict whether a brand will be considered in a specific, new context. |

| Product Portfolio & Innovation | New products or packaging formats are designed to bridge the gap into new CEPs (e.g., creating a travel size to enter the on-the-go situational node). Innovation is driven by situational utility. | Innovation focuses on more of the same variants (e.g., new flavors for the same use case) that merely cannibalize existing sales among heavy users without expanding the brand into new buying situations or reaching light buyers. |

| Targeting & Acquisition | Growth is driven by acquiring light buyers by making the brand relevant in the infrequent situations they enter the category. The strategy assumes buyers are polygamously loyal and move between brands based on context. | The strategy focuses on heavy users and brand fans through loyalty programs. This ignores the law of Double Jeopardy and fails to build the mental availability required to capture the vast majority of the market who only buy occasionally. |

Genesis & Scientific Origin

The concept of Category Entry Points (CEPs) was pioneered and formalized by Professor Jenni Romaniuk and the team at the Ehrenberg-Bass Institute for Marketing Science. While the broader concept of Mental Availability was introduced in Byron Sharp’s seminal work How Brands Grow (2010), the specific framework for identifying, measuring, and building CEPs was detailed extensively in How Brands Grow Part 2 (Romaniuk & Sharp, 2015). This research moved brand tracking away from image attributes (how people describe a brand) toward situational cues (when people think of a brand).

“Brands with the highest Mental Share typically have a market share 2x larger than their nearest competitor.”

The Mechanism: How & Why It Works

The mechanism of Category Entry Points is rooted in the Associative Network Theory of Memory. Human memory is structured as a web of nodes (concepts) connected by links (associations). In a marketing context, the Category is the central node, and Entry Points are the situational triggers that lead a consumer to that node.

When a consumer enters a buying situation (e.g., I need a quick lunch), their brain performs a lightning-fast retrieval process. The brands that have the strongest and most numerous links to that specific trigger (quick lunch) have the highest probability of being retrieved. This is Mental Market Share.

There are three critical layers to this mechanism:

1. The Retrieval Competition: In any given moment, the brain does not scan every brand in existence. It only retrieves a small consideration set based on the specific cue. If your brand is linked to celebration but the consumer is in stress relief mode, you aren't even in the race.

2. The 7 Ws Framework: Romaniuk identifies that CEPs generally fall into seven categories: Why (motives), When (time of day/week), Where (location), With Whom (social context), With What (complementary products), Feeling What (emotional state), and While (concurrent activities).

3. The Link Quantity Advantage: Larger brands aren't just liked more; they are linked to *more* CEPs. A market leader might be thought of for breakfast, on the go, and as a treat, whereas a small brand is only thought of for as a treat. Growth is the process of building these additional links without losing the existing ones.

Real-World Example:

McDonald's (McCafé Expansion)

Situation

For decades, McDonald's dominated the quick, cheap lunch/dinner CEP. However, their growth was hitting a ceiling because they weren't the entry point for the morning coffee ritual or the mid-afternoon premium snack. Starbucks and Dunkin' owned those situational cues.

Result

By launching McCafé and investing heavily in advertising that specifically targeted the morning commute and afternoon pick-me-up CEPs, McDonald's didn't just sell more coffee; they increased the total number of situations where the brand was a valid choice. This expansion of mental availability led to a significant increase in total transactions and market share, as the brand became relevant in time-slots and contexts where it was previously invisible.

Strategic Implementation Guide

Conduct a CEP Audit

Use the 7 Ws (Why, When, Where, With Whom, With What, Feeling, While) to map every possible reason a human might enter your category. Don't guess; use quantitative research to see which cues are most common.

Measure Your Mental Share

Calculate your Share of Mind for each CEP. Identify where you are strong and where you are currently a ghost compared to the market leader.

Prioritize High-Propensity Cues

You can't own everything at once. Select 2-3 CEPs that have high volume but where your brand is currently under-represented. These are your growth vectors.

Align Creative to the Trigger

Your advertising shouldn't just show your product; it must vividly depict the CEP. If you want to own Friday night wind-down, your creative needs to show the Friday night wind-down context explicitly.

Maximize Reach, Not Frequency

To build CEPs, you need to reach the entire category buyer base. Use broad-reach media to ensure that even light buyers start linking your brand to the target situational cues.

Ensure Visual Consistency

Use your Distinctive Brand Assets (DBAs) in every CEP-focused ad. The cue (the situation) must be instantly linked to the brand (the asset) for the memory structure to form.

Monitor Mental Availability

Move away from Brand Love or NPS metrics. Instead, track Mental Penetration (how many people link you to at least one CEP) and Mental Network Size (how many CEPs the average buyer links to your brand).

Frequently Asked Questions

Can a brand own too many Category Entry Points?

In theory, no. The largest brands in the world (Coca-Cola, Amazon, Nike) own the most CEPs. However, in practice, your budget is the limit. Trying to link a brand to ten different situations with a shoestring budget results in weak associations across the board. You are better off owning one or two cues completely before expanding to the next. Focus on building Mental Penetration first.

Does this mean we should stop talking about our product's unique features?

Features only matter if they are relevant to the CEP. If your feature makes the product faster, it should be marketed in the context of rushed situations. A feature without a situational cue is just a lonely fact that nobody will remember when it actually comes time to buy. Link the feature to the Why or the When.

How do CEPs differ from traditional Positioning?

Traditional positioning tries to put a brand in a box relative to competitors (e.g., The most premium option). CEPs put the brand in the customer's life (e.g., The option for when I want to impress a date). Positioning is often an ego-driven exercise for the brand; CEPs are a map of human behavior and memory retrieval.

Are emotional triggers considered Category Entry Points?

Absolutely. Feeling What is one of the 7 Ws. Emotions like feeling rewarded after a hard day or feeling anxious about a big presentation are powerful entry points. However, physical cues (When/Where) are often easier for consumers to recall and for marketers to target via media buying.

Do B2B brands have Category Entry Points?

Yes, and they are arguably more important in B2B. A B2B CEP might be When the annual audit is approaching or When the legacy software crashes for the third time this week. B2B buyers have very specific situational triggers, and the brand that is mentally available during those high-stress windows wins the contract.

Sources & Further Reading

Related Marketing Laws

The Law Of Repertoire Buying

Consumers buy from a set of acceptable brands, not one favorite.

The Law Of Mental Availability

Brands grow by being easily thought of in buying situations.

The Law Of Physical Availability

Brands must be easy to buy wherever and whenever people want them.

The Law Of Memory Building

Advertising works by building memory structures, not changing minds.